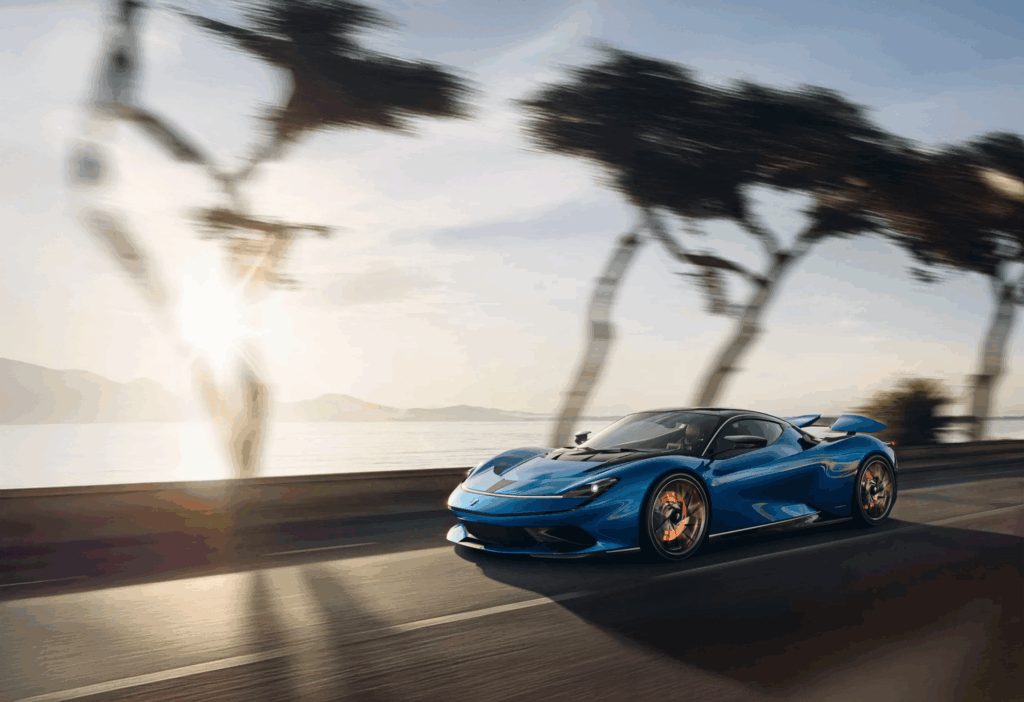

Luxury cars have always turned heads, but now they’re turning into business tools. Across Australia, small and medium-sized businesses are increasingly financing prestige and exotic vehicles — not just for the thrill of driving, but to build their brand, attract clients, and stand out in competitive industries.

From real estate agents to medical specialists, entrepreneurs are using high-end vehicles as part of their marketing strategy. A luxury car parked outside a listing or featured in a social media post can signal success, build trust, and even open doors to new business.

Nick McGrath, CEO of Moneytech, saw the opportunity firsthand. “We kept hearing from brokers and business owners about how hard it was to get finance for prestige vehicles. Traditional lenders just weren’t flexible enough,” he said. That’s why Moneytech launched Luxury Line — a tailored finance solution for exotic cars up to $1.2M, designed specifically for business use.

Interestingly, many buyers in this space could pay outright — but they choose to finance. Chad Arenson, Director of Fuel Asset Finance, explains why: “It’s about cashflow and opportunity cost. If you’re spending half a million dollars, that money could be working harder elsewhere in the business.”

He also points out that luxury cars are becoming more than just transport — they’re part of a company’s identity. “In industries like property development, a prestige car can help attract clients and build credibility. Social media has amplified that. Businesses are using vehicles as visual proof of success.”

But financing these cars isn’t always straightforward. Banks often apply rigid rules, rejecting applications based on brand or perceived resale risk. “We’ve seen approvals for Ferraris and Lamborghinis, but rejections for McLarens — purely based on assumptions about resale value,” Arenson said.

That’s where Moneytech’s broker-first approach has made a difference. “We worked closely with brokers to shape the product,” McGrath said. “We’re seeing more SMEs who don’t fit the traditional mould, and we wanted to build something that actually works for them.”

Market conditions are also helping. The inflated “COVID tax” on luxury vehicles has eased, with prices stabilising and more inventory becoming available. Arenson shared a recent deal where a car with just 1,800 kilometres sold for $610,000 — nearly $200,000 less than its original price.

Unlike heavy machinery, prestige cars can offer broader resale markets and, in some cases, hold their value — especially limited editions. “A $400,000 excavator might depreciate just as fast as a luxury car,” Arenson said, “but the car can also be used for marketing, client engagement, and even international resale. That dual purpose is what sets them apart.”

Of course, lenders still need to see a business purpose. Whether it’s branding, marketing, or operational use, the vehicle needs to fit into the business model. “That’s what separates a smart investment from a personal indulgence,” McGrath said.

As prestige car culture blends with entrepreneurial ambition, the appetite for exotic vehicle finance is only growing. With social media driving visibility and SMEs focused on projecting success, luxury cars are becoming a powerful tool for business growth — and Moneytech is helping brokers make it happen.

To take advantage of our new Luxury & Exotic vehicle finance, enquire now on the Contact Page of the website.