Moneytech and Fuel Asset Finance point to social media and brand-building as key drivers of SME appetite for luxury vehicles

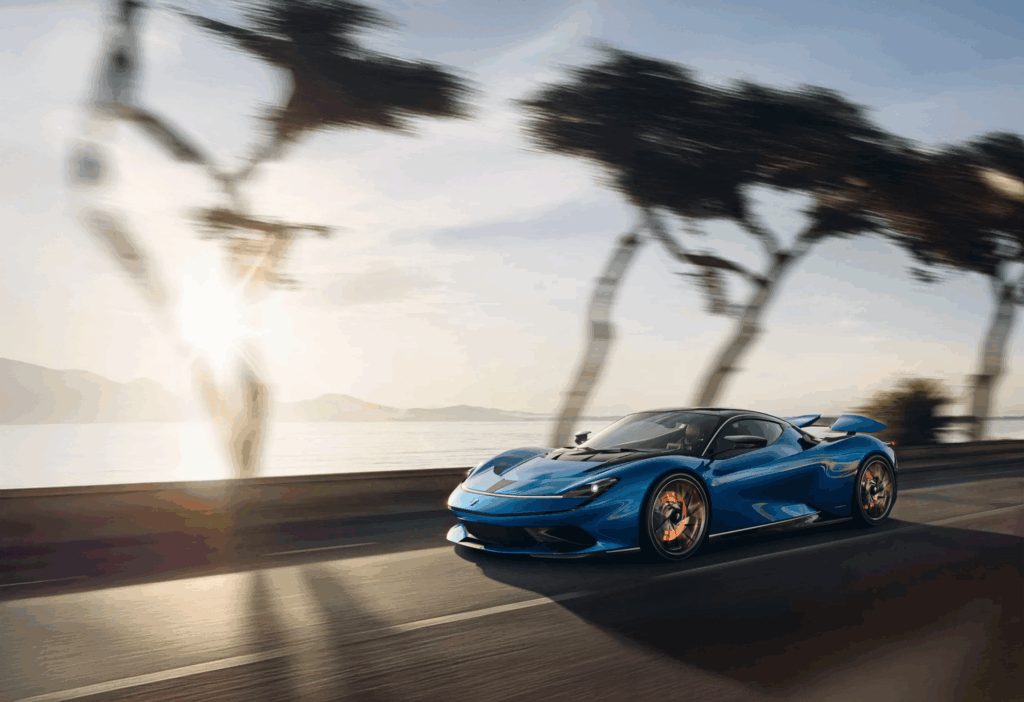

In Australia, the demand for luxury and exotic cars is growing, and more entrepreneurs are financing these vehicles not just for the driving experience but also to establish their brand, draw in customers or in some cases build followers, and show success in their chosen industry.

Nick McGrath, CEO at Moneytech and an avid car enthusiast himself, recognised the challenges surrounding the financing of prestige and exotic vehicles. “Having seen how difficult it can be for business owners to access finance in this space, and hearing the same frustrations from brokers, we wanted to create a solution that better reflects the realities of modern SMEs,” McGrath said. “Large institutions often apply blanket rules that don’t take into account the nuance of particular industries or assets. We wanted to do things differently.”

While buyers in this space often have the capital to pay outright, financing remains the preferred option. Chad Arenson, Director of Fuel Asset Finance, said the choice is often about cashflow and opportunity cost. “No one wants to outlay that much cash and keep it in an asset that isn’t returning them money in the business. If you’re spending half a million dollars, that same capital could be working harder elsewhere,” Arenson said.

He added that prestige cars are playing a growing role in industries like real estate and property development, where self-image is central to winning business. “For some industries, a luxury car is part of the brand itself. It can help attract clients, build credibility and even open new doors. Social media has only accelerated that, with businesses using vehicles not just as transport, but as part of their marketing identity and strategy.”

Yet financing exotic cars isn’t always straightforward. Traditional banks often take a conservative approach, rejecting applications based on brand or resale risk. “We’ve seen banks approve finance on Ferraris and Lamborghinis but say no to McLarens simply because of perceived resale or reliability issues. That kind of inconsistency can be frustrating for buyers,” Arenson said.

McGrath said Moneytech has worked closely with brokers to help shape its approach to luxury and niche asset finance. “We’re seeing more enquiries from SMEs who don’t fit neatly into traditional lending criteria, and that demand is particularly strong for niche areas such as specialist equipment or prestige vehicles. Working with brokers has been key to ensuring we design products that genuinely respond to what business owners need,” he stated.

According to Arenson, the collaboration with Moneytech had been a welcome change from the typical lender relationship. “It’s good to see a lender that not only listens but actually acts,” he said. “Moneytech involved brokers from the outset to make sure the product worked for both lenders and clients, which has been a big step forward for the industry.”

Market conditions are also influencing demand. The inflated “COVID tax” that saw luxury cars selling at record highs has eased, with prices now normalising and vehicles becoming more accessible. Arenson pointed to a recent transaction where a car with just 1,800 kilometres on the clock sold for $610,000 – nearly $200,000 less than the original purchase price. “These cars are more available now, prices are fairer, and the desire to project success – whether online or in business – has only grown. I think we’ll see more SMEs looking at luxury cars as both a lifestyle purchase and a branding tool.”

He also noted that unlike heavy machinery or other depreciating assets, prestige cars can offer wider resale markets and, in some cases, hold their value, particularly for limited edition models. “Someone buying a $400,000 excavator may face just as much depreciation as a luxury car, but the difference is that a prestige vehicle can also be used for marketing, client engagement and even international resale. That dual purpose is what sets them apart.”

From property developers to medical specialists, the borrower profile is broadening. What remains constant is the need to demonstrate a business purpose. “If it’s being purchased through the business, lenders will want to see that it fits into the business model, whether through branding, marketing or operational use. That adds a layer of legitimacy to what might otherwise look like a personal indulgence,” McGrath said.

As prestige car culture collides with entrepreneurial ambition, the outlook for luxury vehicle finance remains strong. With social media fuelling demand, prices stabilising, and SMEs increasingly focused on projecting success, the appetite for exotic cars is set to accelerate.

Moneytech Media

For any media enquiries, please contact:

Samantha Oakey

Head of Marketing

Samantha.Oakey@moneytech.com.au | 0424798956